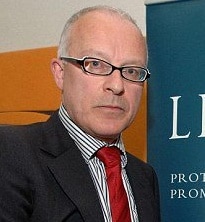

Shiner: Struck off last year

Struck-off solicitor Phil Shiner has had his bankruptcy extended by five years after he gifted away nearly £500,000 worth of assets to family members before declaring himself bankrupt and was unable to pay £6.5m back to his creditors.

Phil Shiner, 61, petitioned for his own bankruptcy in March 2017, declaring that he had no money to pay his creditors following the closure of his Birmingham law firm Public Interest Lawyers (PIL) the previous year after its legal aid contracts were pulled.

A year ago, a Solicitors Disciplinary Tribunal upheld 22 charges of professional misconduct, including dishonesty and lack of integrity, against Mr Shiner. They related mainly to claims he brought against the Ministry of Defence over alleged abuse of Iraqis by British soldiers.

Restrictions arising from a bankruptcy last for 12 months but Mr Shiner’s have been extended to six years following his unacceptable behaviour when he tried to deny paying his creditors, including liabilities arising in connection with PIL, by gifting his assets to his family.

According to the Insolvency Service, Mr Shiner started off by selling a commercial property for £245,000, which he paid to PIL.

He then transferred ownership of his house worth £300,000 with no mortgage, along with two guitars he valued at £3,500 and other artwork, to a family trust in December 2016. The terms of the trust allowed Mr Shiner to remain living in the property, despite not owning it.

In January 2017, Mr Shiner sold a second commercial property for £305,000 and again paid the proceeds into PIL.

Mr Shiner then transferred £94,908 from PIL into a personal pension fund and a further £74,485 was placed into a trust account to help maintain his family. The remainder was allegedly used to pay PIL’s creditors.

However, the Official Receiver has since been able to recover £483,538. This includes selling Mr Shiner’s home, which the Official Receiver is in the process of doing.

The Insolvency Service said the total outstanding amount owed in Mr Shiner’s bankruptcy estate comes in at just under £6.5m.

Justin Dionne, Official Receiver from the Insolvency Service, said: “Mr Shiner thought he could be clever by giving away his assets to his family members so that when he declared himself bankrupt there wasn’t anything to pay his creditors with.

“Sadly he was mistaken as all his activities were easily spotted and we have since been able to recover a substantial amount of money, even if it was in his family’s name.”

In addition, Mr Shiner cannot manage or control a company until 2024 without leave of the court.

Scum of the earth is shiner,because of a corrupt establishment,he didn’t go to prison for at least five years cause the judge thought he had suffered enough with his downfall. The judge should be struck off immediately for negligence in his decision. He should be made to go and speak to the soldiers,who’s life’s he and shiner have ruined